Monday, September 16, 2013

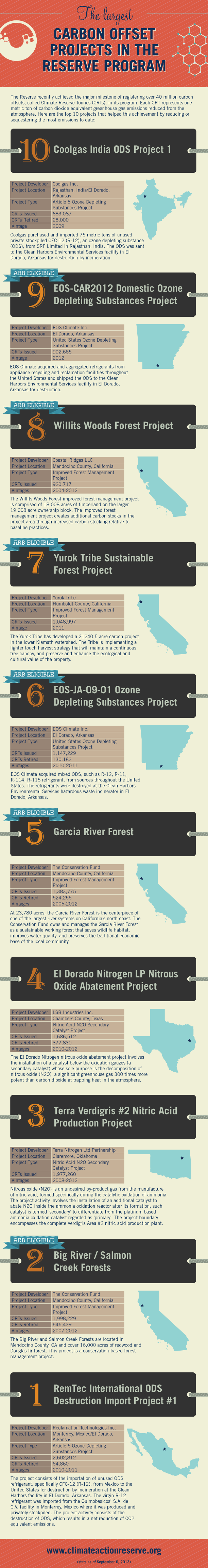

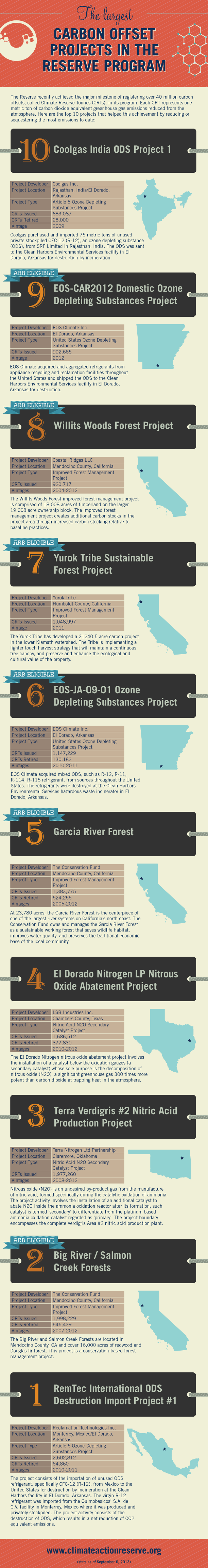

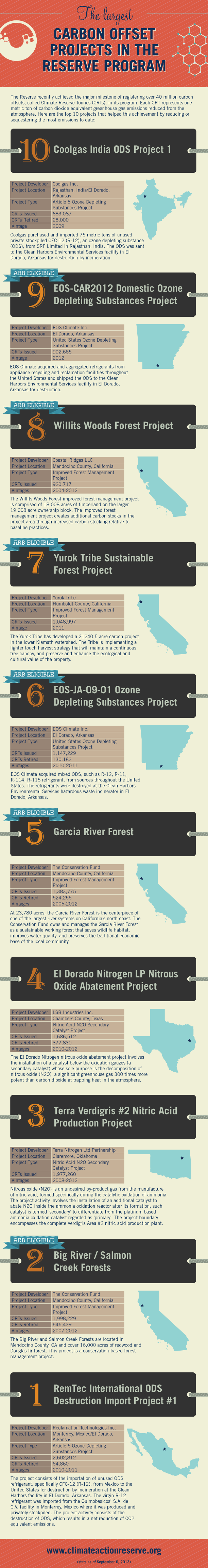

Top ten projects that have earned the most CRTs in the Reserve

We recently achieved the significant milestone of issuing over 40 million carbon credits, each representing one metric ton of carbon dioxide equivalent greenhouse gas emissions reduced or sequestered from the atmosphere. Learn more about the top 10 largest offset projects in the Reserve that helped this achievement:

Labels:

buy refrigerant,

cfc,

destruction,

ods,

r11,

r113,

r114,

r115,

r12,

r13,

refrigerant,

remtec international,

sell refrigerant

Safeway Must Fix Ozone-Depleting Refrigerant Leaks Nationwide

WASHINGTON, DC, September 5, 2013 (ENS) – Safeway, the second largest U.S. grocery store chain, has agreed to pay a $600,000 civil penalty and implement a corporate-wide plan to reduce its emissions of ozone-depleting substances from refrigeration equipment at 659 of its stores in a settlement of alleged violations of the federal Clean Air Act.

The settlement, estimated to cost approximately $4.1 million, involves the largest number of facilities to be brought into compliance under the Clean Air Act’s regulations governing refrigeration equipment.

“This first-of-its-kind settlement will benefit all Americans by cutting emissions of ozone-depleting substances across Safeway’s national supermarket chain,” said Robert Dreher, acting assistant attorney general for the Justice Department’s Environment and Natural Resources Division. “It can serve as a model for comprehensive solutions that improve industry compliance with the nation’s Clean Air Act.”

The settlement agreement resolves allegations by the U.S. Environmental Protection Agency and Justice Department that Safeway violated the Clean Air Act by failing to promptly repair leaks of the hydro-chlorofluorocarbon HCFC-22, a common refrigerant used by supermarkets that is a greenhouse gas and an ozone-depleting substance.

The grocery chain also failed to keep adequate records of the servicing of its refrigeration equipment, the government agencies allege.

EPA regulations issued under Title VI of the Clean Air Act require that owner or operators of commercial refrigeration equipment that contains over 50 pounds of ozone-depleting refrigerants, and that has an annual leak rate greater than 35 percent repair such leaks within 30 days.

HCFC-22 is up to 1,800 times more potent than carbon dioxide in terms of global warming emissions. The measures that Safeway has committed to are expected to prevent over 100,000 pounds of future releases of ozone-depleting refrigerants that destroy the ozone layer.

Safeway will now implement a corporate refrigerant compliance management system to comply with stratospheric ozone regulations.

Under the settlement, Safeway has agreed to reduce its corporate-wide average leak rate from 25 percent in 2012 to 18 percent or below in 2015. The company will reduce the aggregate refrigerant emissions at its highest-emission stores by 10 percent each year for three years.

“Safeway’s new corporate commitment to reduce air pollution and help protect the ozone layer is vital and significant,” said Cynthia Giles, assistant administrator for EPA’s Office of Enforcement and Compliance Assurance.

“Fixing leaks, improving compliance and reducing emissions will make a real difference in protecting us from the dangers of ozone depletion, while reducing the impact on climate change,” said Giles.

HCFCs deplete the stratospheric ozone layer, which allows dangerous amounts of cancer-causing ultraviolet rays from the sun to strike the Earth, leading to adverse health effects that include skin cancers, cataracts, and suppressed immune systems.

“The impact of ozone depletion is a global phenomenon, and the health and environmental harm as a result of Safeway’s emissions do not have particularized impact on communities near stores where the violations occurred,” explains the EPA. “However, all citizens may be more susceptible to skin cancers, cataracts and immune system suppression as a result of violations like these.”

Under the Montreal Protocol, an international treaty, the United States is implementing strict reductions of ozone-depleting refrigerants, including a production and import ban on HCFC-22 by 2020.

The settlement is part of EPA’s national enforcement initiative to control harmful air pollution from the largest sources of emissions, including large grocery stores.

EPA’s GreenChill Partnership Program works with food retailers to reduce refrigerant emissions and decrease their impact on the ozone layer and climate change by transitioning to environmentally friendlier refrigerants, using less refrigerant and eliminating leaks, and adopting green refrigeration technologies and best environmental practices.

Safeway, headquartered in Pleasanton, California has 1,412 stores in the United States and 2012 revenues of $44.2 billion. Safeway operates companies under the banner of Vons in southern California and Nevada, Randalls in Texas, and Carrs in Alaska.

The settlement was lodged Wednesday in the U.S. District Court for the Northern District of California, and is subject to a 30-day public comment period and final court approval. It will be available for viewing at www.justice.gov/enrd/Consent_Decrees.

Labels:

134a,

404a,

407c,

410a,

buy refrigerant,

Ozone Depleting Substance,

r12,

r22,

refrigerants,

sell refrigerant

Tuesday, August 27, 2013

End Of The Season Reduction Sale

End Of The Season

Reduction Sale

Available for immediate

shipment. Special pricing in place on a ½ pallet minimum of R134a, R404A, R407C

and R410A.

Stock up for the 2014 season

with the reduced cost of R134a, R404A, R407C and R410A. This pricing will not

last long with shipping cost included. Contact A-Gas RemTec Today For the

Special Pricing 1-888-873-6832.

A-Gas

RemTec also reclaims used refrigerants; our specialized equipment and expertise

allow us to offer a complete reclamation and product stewardship package for

refrigerant users.

We

purchased used R-11, R-12, R-13, R-22, R-113, R-114, R13b1, R-400, R-500,

R-502, R-503

Depending

on your needs, our Refrigerant Program features

·

Pickup of

recovered refrigerants within 24 hours

·

Acceptance of

follow-purity R-22 to 90%

·

Free disposal of

mixed and unusable refrigerants

·

All freight

arrangements paid by A-GAS RemTec

·

Documentation is

provided for your EPA record keeping

·

Recovery tank

refurbishment & certification to DOT standards

·

Refrigerant

banking and storage service

A-GAS RemTec is an EPA certified reclamation facility

Contact A-Gas RemTec Today for all of your refrigerant needs.

1-800-372-1301

419-867-3279/fax

Labels:

12,

22,

buy refrigerant,

I want to buy refrigerant,

I want to sell refrigerant,

r-22,

r11,

r12,

r134a,

r22,

r404a,

r407c,

r410a,

sell refrigerant

Monday, August 26, 2013

Stopped Cold: Mercedes Sales Blocked in France

BERLIN — Even as showrooms in Europe prepare for the arrival of 2014 vehicles, authorities in France have sparked controversy with a drastic action: blocking the registration — effectively shutting down sales — of some popular new Mercedes-Benz cars, including the A-Class, B-Class, CLA and SL models.

The French environment ministry ordered the ban in response to the German carmaker’s defiance of a European Union regulation on the refrigerants permitted in automotive air-conditioning systems, and the ministry says that it won’t back down until Daimler, the parent of Mercedes, complies. The European Union, though supportive of France’s position, has agreed to step in and referee to keep the squabble from spreading.

The French environment ministry ordered the ban in response to the German carmaker’s defiance of a European Union regulation on the refrigerants permitted in automotive air-conditioning systems, and the ministry says that it won’t back down until Daimler, the parent of Mercedes, complies. The European Union, though supportive of France’s position, has agreed to step in and referee to keep the squabble from spreading.

Why such an uproar over a matter as arcane as an air-conditioning refrigerant?

The ban on registrations was put in place after Mercedes refused to switch to a refrigerant compound that is considerably more climate-friendly than the one currently used in almost all car air-conditioning systems. Mercedes contends that in its crash tests and other independent safety research, the replacement material was flammable in cases where it leaked onto hot engine parts, and that it produced a dangerous gas when burned — increasing the potential harm to passengers in an accident.

European regulators have agreed to review the German test results as part of the process of resolving the tiff. Because of the safety concerns, Germany’s Federal Motor Transport Authority approved the new models for sale with the current refrigerant, a position that escalated the matter from a disagreement over technology to a political dispute.

The issue is of interest to American automakers, as regulators in the United States are likely to consider the new European rules. Naturally, it would benefit the global auto industry to select one common refrigerant for all markets, making it possible to build a single air-conditioning system for domestic and export models.

The imbroglio heated up in the 1970s, when the refrigerant compound known as R-12, a chlorofluorocarbon, was deemed a threat to the earth’s protective ozone layer. Like other fluorocarbons, it was outlawed and replaced with supposedly benign alternatives. In the case of vehicles, an ozone-friendly compound known as R-134a took its place. The move is generally regarded to have been effective: since the worldwide shift away from fluorocarbons, the ozone hole has not only stopped growing, it has actually contracted.

But R-134a was found to have its own warts, namely that when leaked, the fluid serves as a potent greenhouse gas, packing a punch 1,400 times as great as carbon dioxide, the Environmental Protection Agency says. When that property came to the attention of the European Union, it mandated that as of 2011 any refrigerant with a global warming potential more than 150 times that of carbon dioxide would be forbidden in all newly engineered models. By 2017, this ban would apply to all new vehicles sold.

In the search for substitute compounds for R-134a, nonflammable carbon dioxide was championed as a viable alternative, and Mercedes announced this month that it would continue to develop CO2-based systems. Carbon dioxide is commonly used as an industrial refrigerant — worldwide by the Coca-Cola Company, for instance — and is cheap and abundant.

But converting to carbon dioxide-based climate control systems, which require high operating pressures, would entail hardware modifications costing around $130 per vehicle, according to Jürgen Resch, director of the watchdog group German Environmental Aid, based in Berlin.

In Europe, automakers chose a new refrigerant developed by Honeywell International and DuPont, called R-1234yf, that has a far lower global warming potential than R-134a (only four times that of carbon dioxide, according to the E.P.A.) and can replace it without any changes to the hardware under the hood. Honeywell and DuPont control the global supply of R-1234yf, and the companies are forecast to reap billions of dollars in sales.

Mercedes originally complied with the refrigerant directive, but its safety tests showed R-1234yf to be flammable, a finding that watchdog groups agreed with.

“The Daimler tests weren’t the first that showed R-1234yf to be extremely dangerous,” Mr. Resch said. “Four years ago, independent testing came to these conclusions, but at the time the likes of Daimler didn’t want to listen. We were surprised but pleased to see they eventually came to the same conclusion.”

Late last year, Mercedes recalled cars fitted with R-1234yf-based cooling systems, saying the company would return to R-134a until a better substitute was found.

France says it will remain steadfast. The registrations of noncompliant Mercedes models “will remain forbidden in France as long as the company does not to conform to European regulations,” the environment ministry told Reuters.

The blocked models account for most of Daimler’s French business and 2 percent of its global sales. Daimler is contesting the ban in court, and a hearing was scheduled for Aug. 23.

The tussle might lead to a better solution for all parties, including American carmakers. Proponents of carbon dioxide, water and air-based air-conditioning systems say that Honeywell and DuPont squeezed them out of the competition before they could get a fair hearing.

The German automakers, at least, are ready to look again. According to Der Spiegel, the German weekly, an air-cooled air-conditioner is nearly ready for market and would already be on the road had the playing field for a replacement system been level.

Labels:

134a,

22,

buy refrigerant,

hfc-134a,

I want to sell refrigerant,

r-12,

r-22,

r12,

r134a,

refrigerants

Tuesday, August 20, 2013

A-Gas RemTec's Refrigerant Consignment Program

Refrigerant

Consignment Program:

A-Gas RemTec’s

Refrigerant Consignment Program has been developed to save you time and

money. We will put refrigerants at your

site and you use when needed. This eliminates the time and cost of running to

the wholesale house to pick up what you need.

The product

will be sent to your location at no cost to you and A-Gas RemTec will bill you

for only what you have used for that month. There are no service fees or hidden

charges. We supply you with what you need for when you need it.

Call today

for more information about A-Gas RemTec’s Refrigerant Consignment Program!

1-888-873-6832

Wednesday, August 14, 2013

R134a Refrigerant

Do

you use R-134a refrigerant?

A-Gas RemTec can provide you with R-134a in 30lb, 145lb, 1,000lb, 2,000lb, ISO Truck Tank and 30lb pallet quantities.

The R-134a meets AHRI 700-2006 Specification and we provide a certificate of analysis for every shipment.

Are any of your cylinders out of test date?

A-Gas RemTec is a certified Department of Transportation (DOT) hydrostatic testing facility.

We'll internally wash, hydrostatically test and recertify your tanks.

Other required services (based on cylinder size) and optional services are available.

Do you recover R-22?

A-Gas RemTec will pay you for it if it meets 98% purity.

We'll pay the freight both ways, if you can provide us with our minimum net weight requirement of R-22.

A-Gas RemTec can provide you with R-134a in 30lb, 145lb, 1,000lb, 2,000lb, ISO Truck Tank and 30lb pallet quantities.

The R-134a meets AHRI 700-2006 Specification and we provide a certificate of analysis for every shipment.

Are any of your cylinders out of test date?

A-Gas RemTec is a certified Department of Transportation (DOT) hydrostatic testing facility.

We'll internally wash, hydrostatically test and recertify your tanks.

Other required services (based on cylinder size) and optional services are available.

Do you recover R-22?

A-Gas RemTec will pay you for it if it meets 98% purity.

We'll pay the freight both ways, if you can provide us with our minimum net weight requirement of R-22.

Labels:

134a,

22,

22 recovery,

buy refrigerant,

hcfc 22,

hfc-134a,

I want to sell 22,

r-22,

r134a,

sell refrigerant

Tuesday, August 13, 2013

German KBA Authority Offers New Report on AC Refrigerant Soap Opera

If the Daimler AG versus France air-conditioning refrigerant saga would be a book, this new information would be the chapter when the plot suddenly thickens.

As you all probably know by now, France has banned the sale of the Mercedes-Benz A-Class, B-Class and the CLA on their territory over the models' use of the R134a AC coolant, which will be outlawed by the European Union from 2017 for environmental reasons.

Germany's Federal Motor Transport Authority (KBA) recently issued a report of its findings following the subsequent testing of a number of cars that use the new R1234yf air conditioning coolant, which is set to replace the old R134a.

Their conclusion? The new refrigerant - which has been ostracized by Daimler AG following over 100 in-house test that proved it possesses an increased fire risk during certain types of head-collisions – is more hazardous than the old one, but it doesn't comprise a serious danger.

“Due to the comparisons with the previous refrigerant 134a in Stage 3, one can ascertain that the safety level of cars tends to deteriorate when 1234yf is used,” the KBA report mentioned.

Although the report is kind of in line with France's stance in the matter, looking deeper in the details given it also appears that Daimler AG is not exactly the boy who cried wolf when there wasn't any wolf in sight.

Of the four cars tested by the KBA (A Mercedes-Benz B-Class, A Hyundai i30, Subaru Impreza and an Opel Mokka) one of them burst into flames and also emitted a pretty considerable amount of the highly toxic hydrogen fluoride gas.

According to the report, quoted by Reuters, “non-negligible” amounts of the gas were detected in two of the other cars being crash tested, but the coolant itself only ignited in one test. In other words, for the time being, everyone is right about the matter. A more comprehensive final report will be released in mid-september, while the EU officials will obviously have the final word. Our say? Why don't you check out our editorial to find out a more personal opinion.

As you all probably know by now, France has banned the sale of the Mercedes-Benz A-Class, B-Class and the CLA on their territory over the models' use of the R134a AC coolant, which will be outlawed by the European Union from 2017 for environmental reasons.

Germany's Federal Motor Transport Authority (KBA) recently issued a report of its findings following the subsequent testing of a number of cars that use the new R1234yf air conditioning coolant, which is set to replace the old R134a.

Their conclusion? The new refrigerant - which has been ostracized by Daimler AG following over 100 in-house test that proved it possesses an increased fire risk during certain types of head-collisions – is more hazardous than the old one, but it doesn't comprise a serious danger.

“Due to the comparisons with the previous refrigerant 134a in Stage 3, one can ascertain that the safety level of cars tends to deteriorate when 1234yf is used,” the KBA report mentioned.

Although the report is kind of in line with France's stance in the matter, looking deeper in the details given it also appears that Daimler AG is not exactly the boy who cried wolf when there wasn't any wolf in sight.

Of the four cars tested by the KBA (A Mercedes-Benz B-Class, A Hyundai i30, Subaru Impreza and an Opel Mokka) one of them burst into flames and also emitted a pretty considerable amount of the highly toxic hydrogen fluoride gas.

According to the report, quoted by Reuters, “non-negligible” amounts of the gas were detected in two of the other cars being crash tested, but the coolant itself only ignited in one test. In other words, for the time being, everyone is right about the matter. A more comprehensive final report will be released in mid-september, while the EU officials will obviously have the final word. Our say? Why don't you check out our editorial to find out a more personal opinion.

Tuesday, July 30, 2013

A-Gas RemTec’s Total Solutions Program Provides Complete Cradle-to-Grave Refrigerant Management

BOWLING

GREEN, Ohio --

Founded in 1986, as

RemTec International, A-Gas RemTec, has provided products and services involved

in managing Ozone Depleting Substances (ODS) and substances high in Global

Warming Potential (GWP) on a worldwide basis. The Company’s patented and proprietary

equipment is used to recover and reclaim Halons and their replacement agents

used in the fire protection industry, and also CFCs, HCFCs, and HFCs used in

refrigerant and HVAC applications.

A-Gas RemTec’s

capabilities represent a complete cradle-to-grave refrigerant management

program known as the Total Solutions™ Program. The Total Solutions™ Program

provides the only complete cradle-to-grave refrigerant management service under

one roof. The total integration of services from beginning to end provides many

cost efficiencies that benefit customers.

The Total Solutions™

Program provides customers with access to a full product line of refrigerants,

including supplies of R22 that can be provided throughout the transitional

industry phase-out.. A-Gas, a market leader in the UK, Australia, South Africa,

and now in the U.S., provides a full range of products at competitive prices.

In association with their sister company, Coolgas, they have nationwide

distribution capabilities for any refrigerants that may be needed.

A-Gas RemTec reclaims

used refrigerants using full distillation processing to return mixed

refrigerants to AHRI 700-12 standards. This provides greater cost efficiencies

to customers by utilizing a higher degree of contaminated refrigerants causing fewer

destruction costs and unusable refrigerants. Refrigerants considered

un-reclaimable or unusable are accepted and destroyed at no cost. All unusable

refrigerants are destroyed on-site at their Bowling Green, Ohio facility. A-Gas

RemTec utilizes Plascon, which is plasma arc destruction technology.

Competitive compensation is offered for refrigerants of value that meet purity

criteria. A-Gas RemTec offers a fleet of cylinders and ISO Tanks that can be

shipped to customers to aid in the recovery of refrigerants. Contrastingly, if

a customer has a recovery tank that needs to be refurbished or recertified,

A-Gas RemTec has a Department of Transportation Certified facility in Bowling

Green, Ohio. As an added service, A-Gas RemTec maintains one of only three AHRI-certified

laboratories in the U.S., providing one of the most accurate and integrated

testing facilities for halocarbons. As an EPA Certified Reclamation Company, a

complete disposition report on all materials processed is provided for

customers to file with their EPA records.

Total Solutions™ Program

offers a complete banking system to securely warehouse and manage the inventory

of critical-use gases. A-Gas RemTec has built and managed strategic banking

reserves for the U.S. Department of Defense and a major U.S. aircraft

manufacturer. The Majority stockholder of A-Gas Group, Lloyds Development

Capital (a division of Lloyds Banking Group, the largest financial institution

in the UK), enables A-Gas RemTec the financial strength to meet any project

requirements.

About A-Gas International

A-Gas is an international group of companies with headquarters in the United Kingdom. A-Gas is a market leader in the supply of refrigerants within its core territories in the U.K., South Africa, and Australia, and has state of the art storage, blending, packaging and reclamation facilities in Bristol, Cape Town, and Melbourne. The company is rapidly growing its market share in Asia and the Americas with sales offices in Singapore, Thailand, China and the USA. For more information, visitwww.agas.com.

A-Gas is an international group of companies with headquarters in the United Kingdom. A-Gas is a market leader in the supply of refrigerants within its core territories in the U.K., South Africa, and Australia, and has state of the art storage, blending, packaging and reclamation facilities in Bristol, Cape Town, and Melbourne. The company is rapidly growing its market share in Asia and the Americas with sales offices in Singapore, Thailand, China and the USA. For more information, visitwww.agas.com.

About A-Gas RemTec

For more information, visit www.remtec.net.

For more information, visit www.remtec.net.

New Compliance Association Unites California Offset Project Developers

Stemming from the Navigating the American Carbon World conference in 2012, the newly formed Compliance Offset Developers Association (CODA) seeks to unite project developers and to support an effective cap-and-trade program in California. CODA provides a platform for sharing technical knowledge and ideas as they pertain to the Air Resources Board.

1 July 2013 | The latest cap-and-trade development to come out of California is reflective of the Golden State’s reputation as the prevailing leader in domestic climate policy. The newly-minted Compliance Offset Developers Association (CODA) is an alliance of six project developers – A-GAS RemTec, Camco, Coolgas, Inc, Diversified Pure Chem, Environmental Credit Corp, and Terrapass – working together with regulators and other offset stakeholders to support an effective statewide offset market.

At the 10th anniversary of the Navigating the American Carbon World conference, North America’s largest carbon event, a number of players in California’s offset market recognized the benefits of exchanging ideas and technical know-how related to the Air Resources Board (ARB). Acknowledging ARB’s impact, their own strength in numbers, and a growing need to respond to future technical processes on a collaborative basis, project developers set out to create a forum for technical discussion and knowledge-sharing regarding ARB protocols and the generation of compliance offsets.

As reported by CODA, policies regulating offsets, transparency, and the timely review of project documents are critical aspects for project developers in generating and issuing offsets. An anticipated 200 million offsets will be required by California’s cap-and-trade program by 2020, further highlighting the need for increased capacity through collective efforts such as CODA, according to the group’s members.

Intended to function from a procedural and technical perspective rather than from a political stance, CODA aims to connect project developers to better understand the rules and regulations of the offset market. According to Derek Six, CEO of Environmental Credit Corp, “the project developers involved in CODA face a wide variety of common issues.” The association was formed out of a “desire to see a marketplace that is effective, practical, and efficient,” adds Six.

While CODA is currently only open to project developers that have at least three registered projects under ozone-depleting substances, forestry, or livestock protocols, there may be potential for including project developers involved in other project types in the future.

In reference to prospective protocols such as rice cultivation, coal mine methane, and REDD+, Charles Purshouse, CODA’s elected chairperson, stated, “If approved, we would welcome members developing those projects.” However, for the time being, the “focus is on the drawing board,” as lobbying for REDD+ and other potential protocols “doesn’t fall under the group’s remit,” adds Purshouse.

CODA holds bi-weekly meetings and discussions to formulate strategy. Companies interested in joining CODA can email nick@terrapass.com.

1 July 2013 | The latest cap-and-trade development to come out of California is reflective of the Golden State’s reputation as the prevailing leader in domestic climate policy. The newly-minted Compliance Offset Developers Association (CODA) is an alliance of six project developers – A-GAS RemTec, Camco, Coolgas, Inc, Diversified Pure Chem, Environmental Credit Corp, and Terrapass – working together with regulators and other offset stakeholders to support an effective statewide offset market.

At the 10th anniversary of the Navigating the American Carbon World conference, North America’s largest carbon event, a number of players in California’s offset market recognized the benefits of exchanging ideas and technical know-how related to the Air Resources Board (ARB). Acknowledging ARB’s impact, their own strength in numbers, and a growing need to respond to future technical processes on a collaborative basis, project developers set out to create a forum for technical discussion and knowledge-sharing regarding ARB protocols and the generation of compliance offsets.

As reported by CODA, policies regulating offsets, transparency, and the timely review of project documents are critical aspects for project developers in generating and issuing offsets. An anticipated 200 million offsets will be required by California’s cap-and-trade program by 2020, further highlighting the need for increased capacity through collective efforts such as CODA, according to the group’s members.

Intended to function from a procedural and technical perspective rather than from a political stance, CODA aims to connect project developers to better understand the rules and regulations of the offset market. According to Derek Six, CEO of Environmental Credit Corp, “the project developers involved in CODA face a wide variety of common issues.” The association was formed out of a “desire to see a marketplace that is effective, practical, and efficient,” adds Six.

While CODA is currently only open to project developers that have at least three registered projects under ozone-depleting substances, forestry, or livestock protocols, there may be potential for including project developers involved in other project types in the future.

In reference to prospective protocols such as rice cultivation, coal mine methane, and REDD+, Charles Purshouse, CODA’s elected chairperson, stated, “If approved, we would welcome members developing those projects.” However, for the time being, the “focus is on the drawing board,” as lobbying for REDD+ and other potential protocols “doesn’t fall under the group’s remit,” adds Purshouse.

CODA holds bi-weekly meetings and discussions to formulate strategy. Companies interested in joining CODA can email nick@terrapass.com.

Tuesday, July 2, 2013

EPA Warns Against Use of Refrigerant Substitutes That Pose Fire and Explosion Risk

FOR IMMEDIATE RELEASE

July 1, 2013

July 1, 2013

WASHINGTON – The U.S. Environmental Protection Agency (EPA) is warning homeowners, propane manufacturers and sellers, home improvement contractors and air conditioning technicians of potential safety hazards related to the use of propane or other unapproved refrigerants in home air conditioning systems.

EPA is currently investigating instances where propane has been marketed and used as a substitute for HCFC-22 (R-22), a refrigerant that is widely used in home air conditioning systems.

Home air conditioning systems are not designed to handle propane or other similar flammable refrigerants. The use of these substances poses a potential fire or explosion hazard for homeowners and service technicians.

EPA is aware of incidents that have occurred both overseas and in the U.S. where individuals have been injured as a result of the use of propane and other unapproved refrigerants in air conditioning systems. We are investigating and will take enforcement actions where appropriate. Other names for these unapproved refrigerants include R-290, 22a, 22-A, R-22a, HC-22a, and CARE 40.

At this time, EPA has not approved the use of propane refrigerant or other hydrocarbon refrigerants in any type of air conditioner. Homeowners and technicians are strongly recommended to limit use of propane or other hydrocarbons to only those appliances specifically designed for these substances and that are properly marked to alert technicians that the equipment contains a flammable substance. EPA has approved the use of propane as a substitute refrigerant for R-22 in industrial process refrigeration systems and in new, stand-alone retail food refrigerators and freezers that are specifically designed to use flammable hydrocarbon refrigerants.

R-22 is being phased out of production and importation under the Montreal Protocol, an environmental treaty ratified by every country in the world designed to reduce and eventually eliminate the use of ozone depleting substances. EPA’s Significant New Alternatives Policy (SNAP) Program has already listed numerous refrigerants with improved environmental, health and safety profiles and continues to evaluate other refrigerants that can be used to replace R-22 and other ozone-depleting substances.

More information about the EPA’s SNAP program: http://www.epa.gov/ozone/snap/

More information about R-22a and alternatives for air conditioning: http://www.epa.gov/ozone/snap/r22a.html

Monday, July 1, 2013

Monday, June 17, 2013

Renewed interest in HC heat pumps in Europe – exclusive interview with D. Colbourne

The increasing availability in Europe of optimised R290 compressors for heat pumps is reviving interest in the technology. During the UNIDO ATMOsphere Technology Summit, hydrocarbons21.com interviewed Mr. Daniel Colbourne, Consultant at Re-phridge, about the historical development of hydrocarbon (HC) heat pumps and the current state of play in Europe.

hydrocarbons21.com: In the 1990s there were several hydrocarbon-based heat pump products for domestic application in the EU market, which subsequently disappeared. What in your view might have caused this?

Daniel Colbourne: There were many hydrocarbon (HC) heat pump products on the European market; Austria, Switzerland, Scandinavia and Germany, mainly from small and medium sized producers. But the EU Pressure Equipment Directive (PED) was introduced which basically states that the components and piping in the refrigeration system must be designed, tested and approved for that particular refrigerant (or refrigerant “group”). The PED requirements for flammable refrigerants are one level above those for the non-flammable, low toxicity fluid “group”, which includes refrigerants like R22.

Previously many companies were taking R22 compressors and adapting them for use with R290. So when the PED came into force it essentially meant that they could no longer utilise those R22 compressors; i.e., they could only use R290 compressors for R290. At the time there were no manufacturers producing the right type of R290 compressors and, since in order to certify compressors for R290, additional approval processes are necessary (which in some cases are costly), the size of the market was evidently not sufficient for manufacturers to justify it. For example, the person that is welding the compressors has got to have a higher level of certification, which implies additional investments for the compressor manufacturers.

So the heat pump manufacturers apparently had little choice, all they could do was to switch to an alternative which was not a flammable refrigerant. I would say that was the main reason for the decline. Given the extensive literature demonstrating the comparatively higher efficiency of R290 and the excellent safety record, it was not performance or hazardous aspects that were responsible.

A number of manufacturers continued with some R290 models (and still do today) in particular for smaller capacity units where R290 hermetic compressors normally used for commercial refrigeration are suitable. Nonetheless, this represents a relatively small portion of the market.

hydrocarbons21.com: In terms of performance and reliability, how were these R290 products performing?

Colbourne: With regards to reliability, when R22 compressors were initially used there were some problems. However, a study presented by a major German player on the development of their R290 heat pumps in 1999 stated that after optimisation of the compressor oil, the reliability of their R290 heat pumps was better than that of their R22 heat pumps. Of course, many companies are currently selling R290 heat pumps, which would not be the case were there reliability issues.

Throughout that period there were many studies published on the efficiency of hydrocarbons in heat pumps and most of them said that R290 performance was at least as good, typically much better than the other alternatives (for space heating purposes). Both the large volume of technical literature and publications from different manufacturers support this. Furthermore, when considering the thermophysical properties of HCs, it is fairly obvious; not only do the thermodynamic properties demonstrate this but also the excellent viscosity and thermal conductivity infers better component performance than most other fluorinated alternatives.

hydrocarbons21.com: More recently do you see a renewed interest in the use of hydrocarbons in heat pumps by European manufacturers?

Colbourne: In general we can see increasing pressure to use heat pumps in Europe as they are seen as a means for accelerating CO2 emission reduction. Within this context it seems rather daft to not use low-GWP refrigerants or particularly natural refrigerants for those types of products where they can be used. There are a fairly large number of manufacturers within Europe (but also Australia and China) that are currently using HCs (as well as other natural refrigerants). In this respect there is increasing interest in some quarters, but of course others are also resisting.

The safety issue is surely already addressed, since relevant safety regulations and standards are available and have been for many years.

hydrocarbons21.com: Heat pump manufacturers often state that the reason they do not offer HC-based heat pumps is that they cannot find optimised HC compressors or other components for the purpose. What would you recommend to the industry for overcoming this barrier?

Colbourne: On the compressor side, at least two major compressor manufacturers are now producing compressors specifically designed and optimised for R290 heat pump systems, implying that this barrier is now becoming resolved. Moreover, there are several companies that make other components, such as controls for hydrocarbons that can be used in heat pumps. These enterprises obviously see that there is a market and they would not invest large sums in the technology unless they had confidence in it.

hydrocarbons21.com: In the 1990s there were several hydrocarbon-based heat pump products for domestic application in the EU market, which subsequently disappeared. What in your view might have caused this?

Daniel Colbourne: There were many hydrocarbon (HC) heat pump products on the European market; Austria, Switzerland, Scandinavia and Germany, mainly from small and medium sized producers. But the EU Pressure Equipment Directive (PED) was introduced which basically states that the components and piping in the refrigeration system must be designed, tested and approved for that particular refrigerant (or refrigerant “group”). The PED requirements for flammable refrigerants are one level above those for the non-flammable, low toxicity fluid “group”, which includes refrigerants like R22.

Previously many companies were taking R22 compressors and adapting them for use with R290. So when the PED came into force it essentially meant that they could no longer utilise those R22 compressors; i.e., they could only use R290 compressors for R290. At the time there were no manufacturers producing the right type of R290 compressors and, since in order to certify compressors for R290, additional approval processes are necessary (which in some cases are costly), the size of the market was evidently not sufficient for manufacturers to justify it. For example, the person that is welding the compressors has got to have a higher level of certification, which implies additional investments for the compressor manufacturers.

So the heat pump manufacturers apparently had little choice, all they could do was to switch to an alternative which was not a flammable refrigerant. I would say that was the main reason for the decline. Given the extensive literature demonstrating the comparatively higher efficiency of R290 and the excellent safety record, it was not performance or hazardous aspects that were responsible.

A number of manufacturers continued with some R290 models (and still do today) in particular for smaller capacity units where R290 hermetic compressors normally used for commercial refrigeration are suitable. Nonetheless, this represents a relatively small portion of the market.

hydrocarbons21.com: In terms of performance and reliability, how were these R290 products performing?

Colbourne: With regards to reliability, when R22 compressors were initially used there were some problems. However, a study presented by a major German player on the development of their R290 heat pumps in 1999 stated that after optimisation of the compressor oil, the reliability of their R290 heat pumps was better than that of their R22 heat pumps. Of course, many companies are currently selling R290 heat pumps, which would not be the case were there reliability issues.

Throughout that period there were many studies published on the efficiency of hydrocarbons in heat pumps and most of them said that R290 performance was at least as good, typically much better than the other alternatives (for space heating purposes). Both the large volume of technical literature and publications from different manufacturers support this. Furthermore, when considering the thermophysical properties of HCs, it is fairly obvious; not only do the thermodynamic properties demonstrate this but also the excellent viscosity and thermal conductivity infers better component performance than most other fluorinated alternatives.

hydrocarbons21.com: More recently do you see a renewed interest in the use of hydrocarbons in heat pumps by European manufacturers?

Colbourne: In general we can see increasing pressure to use heat pumps in Europe as they are seen as a means for accelerating CO2 emission reduction. Within this context it seems rather daft to not use low-GWP refrigerants or particularly natural refrigerants for those types of products where they can be used. There are a fairly large number of manufacturers within Europe (but also Australia and China) that are currently using HCs (as well as other natural refrigerants). In this respect there is increasing interest in some quarters, but of course others are also resisting.

The safety issue is surely already addressed, since relevant safety regulations and standards are available and have been for many years.

hydrocarbons21.com: Heat pump manufacturers often state that the reason they do not offer HC-based heat pumps is that they cannot find optimised HC compressors or other components for the purpose. What would you recommend to the industry for overcoming this barrier?

Colbourne: On the compressor side, at least two major compressor manufacturers are now producing compressors specifically designed and optimised for R290 heat pump systems, implying that this barrier is now becoming resolved. Moreover, there are several companies that make other components, such as controls for hydrocarbons that can be used in heat pumps. These enterprises obviously see that there is a market and they would not invest large sums in the technology unless they had confidence in it.

Beware of Flammable R-22a Refrigerants!

June 12, 2013

With the phaseout of the refrigerant R-22, dangerous replacements are surfacing. Steer clear of purchasing highly flammable products sold that are listed in a form of 22a Refrigerant, as the gas can burn or even explode when in contact with an ignition source.There is great concern over the flammability of these products, when used as a refrigerant in air conditioning equipment. The U.S. Environmental Protection Agency (EPA) has a Significant New Alternatives Policy (SNAP) that maintains lists of acceptable refrigerants in listed applications. EPA has issued some Frequently Asked Questions (FAQ’s) regarding these R-22a products, click here to read these FAQ’s.

These products could pose significant safety risks to homeowners and technicians. Unknowing homeowners who have used this product may have created an exposure to fire or explosion should a leak be present in the home. Technicians that have not been informed of the use of these products face similar risks in that their service equipment is not designed for these products. Inadvertent mixing of recovered gases may contaminate a contractor’s bulk recovery cylinder forcing disposal of the product in place of reclaiming.

There are many approved replacement refrigerants being marketed today; contractors should carefully consider the products they wish to use. For a list of EPA approved alternate refrigerants for residential air conditioning, click here.

Remember, it is illegal for anyone to intentionally mix refrigerants in equipment or to intentionally vent refrigerant to the atmosphere. Use alternate refrigerants wisely; do not top off a system with an alternate refrigerant.

Thursday, June 13, 2013

Coming to America

U.K.'s A-Gas Plans Expansion Into North America

A-Gas’s acquisitions in the U.S. will set it up for a significant expansion into North America, including the international rollout of its refrigerant reclamation technology.Acquiring Assets

Reclamation Technology

Industry Encourages Cap Use on Refrigerants

Industry Encourages Cap Use on Refrigerants

Recent Deaths Demonstrate Dangers of Huffing R-22

By Peter Powell

This past March, Kristal Salcido, a 12-year-old seventh grader in

Victorville, Calif., inhaled HCFC-22 from an air conditioning unit in the

backyard of her grandmother’s home. She was later found passed out on the

bathroom floor. Rushed to the emergency room, Salcido was pronounced brain dead.

Four days later, her family decided to take her off life support.

She had used the R-22 in a ritual called huffing — the intentional inhalation of chemical vapors to attain a mental high or euphoric effect.

Refrigerants such as CFCs, HCFCs, HFCs, and propane are just part of that chemical basket of inhalants. Others are gasoline, paint thinners, nail polish, and nitrous oxide. According to the website www.inhalants.org, one in five students has inhaled a chemical to get high by the eighth grade.

“People really don’t realize how dangerous this is,” said Dr. Craig Sanford, Tulsa, Okla., in a news report broadcast by NewsOn6. “Inhaling this substance prevents the body from getting oxygen and you can get frostbite from it, inside the tissues of your nose, mouth, and face.”

Postoian said that he’s serviced a number of condensing units where the refrigerant had suspiciously been used up.

That “missing refrigerant” aspect was echoed by Ryan Rentmeister, who owns Rentmeister Total Home Service of Salt Lake City. A few years ago in his hometown, people were turning on their air conditioners, but the machines were failing to provide cool air, due to absent refrigerant. “We’ve had four cases in the last week,” he said, suspecting huffing as the cause.

Ronda Szymanski of Advanced Air and Refrigeration Inc., Fort Myers, Fla., said a telltale sign is when service techs find a butter knife laying next to a central air conditioning condenser that has been depleted of refrigerant, with its service port visibly damaged.

Code requirements have been in place since 2009, but these requirements need to be codified by each state, said Gerry Spanger, director of HVACR engineered products for Rectorseal Corp.

So far, at least five states have adopted the codes, said Spanger. However, limiting more widespread acceptance, the codes are only related to new construction. He said eventually the codes will extend into retrofits and existing buildings. “It is not a question of ‘no, this won’t happen.’ It is just a question of how long it takes,” said Spanger.

Once state codes are in place, inspectors cannot sign off on a job until the locking caps are in place.

“The products are a must for companies and technicians to comply with local codes as well as liability concerns connected with refrigerants,” said Oscar Lopez, vice president of sales for JB Industries Inc., Aurora, Ill.

Spanger said that even as all the regulatory aspects eventually fall into place, there is still the possibility of abuse within the HVACR sector. He said he’d even heard of contractors buying the caps, locking them in place when required, and then removing them after an inspection for use in the next project.

“They don’t understand they are laying themselves open to liabilities,” he said.

He also said that even though the caps can only be sold to contractors who are U.S. Environmental Protection Agency (EPA)-certified to handle refrigerants, he had heard of instances of some wholesalers and contractors who sell the caps on websites, even though they may not be able to verify the certification status of the purchaser.

According to Jon Melchi, director of government affairs for Heating, Air-conditioning & Refrigeration Distributors International (HARDI), “Wholesalers and suppliers strongly believe that these products should not be available online. They should only be sold to licensed contractors. As an industry we must be diligent in making sure that the entire channel is aware of best practices regarding these products.”

For example, this past February, Rectorseal Corp. introduced its GasGuard™, a tamper-resistant locking valve cap designed to help prevent refrigerant theft, leaks, and huffing. It screws and locks onto threaded refrigerant Schraeder valves.

“GasGuard restricts unauthorized access because it can only be installed or removed with a unique matching proprietary socket tool,” said Jerry Tomasello, director of marketing for RectorSeal. “It cannot be removed with a core remover or Allen wrench.”

JB’s Lopez also noted that his company is launching a new American-made refrigerant safety cap with greater security under the brand name The Shield.

“SAFE is still actively pushing it and Dominion Service is currently doing a public service campaign in the Hampton Roads, Va., area,” he said. “Our Richmond division has had huge success with the program but Hampton Roads has been a little slower to catch on. We are working on fixing that.

“We are currently installing 10-15 caps each week. We’re confident that number will increase significantly as the summer season hits.”

She had used the R-22 in a ritual called huffing — the intentional inhalation of chemical vapors to attain a mental high or euphoric effect.

Refrigerants such as CFCs, HCFCs, HFCs, and propane are just part of that chemical basket of inhalants. Others are gasoline, paint thinners, nail polish, and nitrous oxide. According to the website www.inhalants.org, one in five students has inhaled a chemical to get high by the eighth grade.

The Hazards of Huffing

In the case of the R-22, “When you inhale it, it kills your brain cells — that’s all,” said Ron Postoian, president of AC Plus Heating & Air of Hesperia, Calif., who was interviewed by television station KTLA for its story on a recent huffing fatality in his home state.“People really don’t realize how dangerous this is,” said Dr. Craig Sanford, Tulsa, Okla., in a news report broadcast by NewsOn6. “Inhaling this substance prevents the body from getting oxygen and you can get frostbite from it, inside the tissues of your nose, mouth, and face.”

Postoian said that he’s serviced a number of condensing units where the refrigerant had suspiciously been used up.

That “missing refrigerant” aspect was echoed by Ryan Rentmeister, who owns Rentmeister Total Home Service of Salt Lake City. A few years ago in his hometown, people were turning on their air conditioners, but the machines were failing to provide cool air, due to absent refrigerant. “We’ve had four cases in the last week,” he said, suspecting huffing as the cause.

Ronda Szymanski of Advanced Air and Refrigeration Inc., Fort Myers, Fla., said a telltale sign is when service techs find a butter knife laying next to a central air conditioning condenser that has been depleted of refrigerant, with its service port visibly damaged.

Curbing the Problem

Regulators and many within the HVACR industry have been working hard to get a handle on this deadly situation. Both the International Mechanical Code 1101.10 and the International Residential Code M1411.6 have mandated that “refrigerant-circuit access ports located outdoors shall be fitted with locking-type tamper-resistant caps.”Code requirements have been in place since 2009, but these requirements need to be codified by each state, said Gerry Spanger, director of HVACR engineered products for Rectorseal Corp.

So far, at least five states have adopted the codes, said Spanger. However, limiting more widespread acceptance, the codes are only related to new construction. He said eventually the codes will extend into retrofits and existing buildings. “It is not a question of ‘no, this won’t happen.’ It is just a question of how long it takes,” said Spanger.

Once state codes are in place, inspectors cannot sign off on a job until the locking caps are in place.

“The products are a must for companies and technicians to comply with local codes as well as liability concerns connected with refrigerants,” said Oscar Lopez, vice president of sales for JB Industries Inc., Aurora, Ill.

Spanger said that even as all the regulatory aspects eventually fall into place, there is still the possibility of abuse within the HVACR sector. He said he’d even heard of contractors buying the caps, locking them in place when required, and then removing them after an inspection for use in the next project.

“They don’t understand they are laying themselves open to liabilities,” he said.

He also said that even though the caps can only be sold to contractors who are U.S. Environmental Protection Agency (EPA)-certified to handle refrigerants, he had heard of instances of some wholesalers and contractors who sell the caps on websites, even though they may not be able to verify the certification status of the purchaser.

According to Jon Melchi, director of government affairs for Heating, Air-conditioning & Refrigeration Distributors International (HARDI), “Wholesalers and suppliers strongly believe that these products should not be available online. They should only be sold to licensed contractors. As an industry we must be diligent in making sure that the entire channel is aware of best practices regarding these products.”

Locked and Loaded

While controlling huffing remains a key aspect of locking caps, the devices have long been offered in the HVACR distribution channel for a number of applications. Even as regulations move toward the requirement of locking caps, the devices themselves are being fine tuned.For example, this past February, Rectorseal Corp. introduced its GasGuard™, a tamper-resistant locking valve cap designed to help prevent refrigerant theft, leaks, and huffing. It screws and locks onto threaded refrigerant Schraeder valves.

“GasGuard restricts unauthorized access because it can only be installed or removed with a unique matching proprietary socket tool,” said Jerry Tomasello, director of marketing for RectorSeal. “It cannot be removed with a core remover or Allen wrench.”

JB’s Lopez also noted that his company is launching a new American-made refrigerant safety cap with greater security under the brand name The Shield.

Contractor Support

Numerous contractors, including Chase Tunnell, president, Dominion Service, Richmond, Va., are strong advocates of locking caps. For a number of years, Tunnell has been involved with the Substance Abuse Free Environment (SAFE) program, which encourages the use of locking caps.“SAFE is still actively pushing it and Dominion Service is currently doing a public service campaign in the Hampton Roads, Va., area,” he said. “Our Richmond division has had huge success with the program but Hampton Roads has been a little slower to catch on. We are working on fixing that.

“We are currently installing 10-15 caps each week. We’re confident that number will increase significantly as the summer season hits.”

Counting down to the ban on R22

As the months pass towards the total ban on the use of R22 for servicing air-conditioning equipment, Kevin Groves of Ergro gives his perspective.

The final removal of the HCFC refrigerant R22 from the world’s air conditioning systems has long been heralded and is now upon us here in the UK. Manufacturers of equipment have not included it in new systems since 2003. In 2010 the use of virgin R22 refrigerant was banned, and systems can only now be serviced utilising reclaimed refrigerant for maintenance. Now the final date in the legislative removal of recycled R22 because of its ozone-depleting properties is near. On 1 January 2015, the use of recycled R22 refrigerant will be banned in the EU.

Practically speaking, where R22 refrigerant is in use, there are two main options to make an air-conditioning system serviceable after the ban comes into force. One option is to convert the existing system to enable it to operate using a legal but often less efficient refrigerant or replacing part of or the entire system.

There are two main routes to a conversion solution.

In some cases it will be possible to make a few modifications to the system, such as replacing some gaskets and the oil, which will enable it to run on a new refrigerant such as R422D. This is known as the drop-in refrigerant option, which, in most cases, will lead to a reduction in cooling capacity and increased running costs.

Where another refrigerant cannot be dropped in, there may be the potential to convert the system by installing new fan coils or condensers whilst still retaining much of the building’s existing internal infrastructure such as piping. As well as increasing system capacity, conversion is likely to improve the overall efficiency of a system through the use of modern refrigerants (except when using the drop-in option).

Both solutions are, however, heavily dependent on site, installation conditions and age of the plant.

Systems not suitable for conversion will need to be replaced. Despite the higher installation costs, replacement can lead to greater system efficiencies, lower maintenance requirements and reduced operating costs.

For building-services engineers, the effect of the legislation is likely to mean that air conditioning will take centre stage in many of their operations in the coming years. It’s important that the engineering community understands what is business-critical air conditioning and impresses the importance of preparedness upon facilities managers and business leaders.

Who should act and when, what market forces and liabilities are involved and why it’s becoming the most important news in air conditioning may not be immediately obvious to many business leaders and even facilities managers. In fact, many people who could be affected most acutely won’t even know if R22 is used in their air conditioning or even realise they are responsible for the air conditioning in the spaces they occupy.

At a recent summit in London, held at the Royal Society of Medicine, Ergro assembled a panel of experts to answer some of these questions and to raise awareness of the issues surrounding the ban of R22.

The panel introduced the subject from their various perspectives and took questions from an invited audience comprising building managers, consultants, architects and business leaders.

There were several points upon which the panel was in complete agreement, chief among which was the need for people to gain the knowledge required to properly evaluate their position in relation to a date which, while it seems distant, taken in the context of the financial cycles and business-critical nature of the systems involved, is actually almost upon us.

I represented Ergro on the panel to offer the insight of a contracting engineer who works with air conditioning for skyscrapers, manufacturing, data centres and offices. Also on the panel were representatives of leading air-conditioning manufacturers Mitsubishi Electric and Daikin, legal and liability expertise from property law firm Taylor Wessing and chartered accountants and chartered tax advisors LB Group.

One question concerned the subtleties of supply and demand of the refrigerant itself. R22 is presently trading at around £30 per kilo in the UK, and this price is rising all of the time. When considering the fact that it will become illegal to buy or sell from the end of 2014 it would seem likely that the upward trend in its value will continue.

And what about installing new equipment? If it’s critical to the business that maintenance is possible and downtime avoidable, as it is in many of the instances where an estimated 750 000 systems using R22 exist, then a lot of companies will be looking to replace equipment at around the same time.

Needless to say, where demand outstrips supply in terms of the expertise to fit new systems, there are likely to be delays that could cause unnecessary risk to business continuity.

While it does seem to be a little way off, the R22 refrigerant ban will very soon make its presence felt across the business community. From now and for the next 18 months and beyond, building-services engineers will be at the heart of making business-critical systems compliant and serviceable into the future. But the whole facilities management and building services industry must come together with manufacturers and business services to help the business community to understand how the changes will affect them. Knowledge is power, and a full evaluation of existing systems will equip business leaders with the knowledge to make the right decisions to get ahead of the ban. More information and a countdown to the ban clock is available at the link below.

Kevin Groves is group operations director with Ergro

- See more at: http://www.modbs.co.uk/news/fullstory.php/aid/11893/Counting_down_to_the_ban_on_R22.html#sthash.HbKs8XtY.dpuf

The final removal of the HCFC refrigerant R22 from the world’s air conditioning systems has long been heralded and is now upon us here in the UK. Manufacturers of equipment have not included it in new systems since 2003. In 2010 the use of virgin R22 refrigerant was banned, and systems can only now be serviced utilising reclaimed refrigerant for maintenance. Now the final date in the legislative removal of recycled R22 because of its ozone-depleting properties is near. On 1 January 2015, the use of recycled R22 refrigerant will be banned in the EU.

Practically speaking, where R22 refrigerant is in use, there are two main options to make an air-conditioning system serviceable after the ban comes into force. One option is to convert the existing system to enable it to operate using a legal but often less efficient refrigerant or replacing part of or the entire system.

There are two main routes to a conversion solution.

In some cases it will be possible to make a few modifications to the system, such as replacing some gaskets and the oil, which will enable it to run on a new refrigerant such as R422D. This is known as the drop-in refrigerant option, which, in most cases, will lead to a reduction in cooling capacity and increased running costs.

Where another refrigerant cannot be dropped in, there may be the potential to convert the system by installing new fan coils or condensers whilst still retaining much of the building’s existing internal infrastructure such as piping. As well as increasing system capacity, conversion is likely to improve the overall efficiency of a system through the use of modern refrigerants (except when using the drop-in option).

Both solutions are, however, heavily dependent on site, installation conditions and age of the plant.

Systems not suitable for conversion will need to be replaced. Despite the higher installation costs, replacement can lead to greater system efficiencies, lower maintenance requirements and reduced operating costs.

For building-services engineers, the effect of the legislation is likely to mean that air conditioning will take centre stage in many of their operations in the coming years. It’s important that the engineering community understands what is business-critical air conditioning and impresses the importance of preparedness upon facilities managers and business leaders.

Who should act and when, what market forces and liabilities are involved and why it’s becoming the most important news in air conditioning may not be immediately obvious to many business leaders and even facilities managers. In fact, many people who could be affected most acutely won’t even know if R22 is used in their air conditioning or even realise they are responsible for the air conditioning in the spaces they occupy.

At a recent summit in London, held at the Royal Society of Medicine, Ergro assembled a panel of experts to answer some of these questions and to raise awareness of the issues surrounding the ban of R22.

The panel introduced the subject from their various perspectives and took questions from an invited audience comprising building managers, consultants, architects and business leaders.

There were several points upon which the panel was in complete agreement, chief among which was the need for people to gain the knowledge required to properly evaluate their position in relation to a date which, while it seems distant, taken in the context of the financial cycles and business-critical nature of the systems involved, is actually almost upon us.

I represented Ergro on the panel to offer the insight of a contracting engineer who works with air conditioning for skyscrapers, manufacturing, data centres and offices. Also on the panel were representatives of leading air-conditioning manufacturers Mitsubishi Electric and Daikin, legal and liability expertise from property law firm Taylor Wessing and chartered accountants and chartered tax advisors LB Group.

One question concerned the subtleties of supply and demand of the refrigerant itself. R22 is presently trading at around £30 per kilo in the UK, and this price is rising all of the time. When considering the fact that it will become illegal to buy or sell from the end of 2014 it would seem likely that the upward trend in its value will continue.

And what about installing new equipment? If it’s critical to the business that maintenance is possible and downtime avoidable, as it is in many of the instances where an estimated 750 000 systems using R22 exist, then a lot of companies will be looking to replace equipment at around the same time.

Needless to say, where demand outstrips supply in terms of the expertise to fit new systems, there are likely to be delays that could cause unnecessary risk to business continuity.

While it does seem to be a little way off, the R22 refrigerant ban will very soon make its presence felt across the business community. From now and for the next 18 months and beyond, building-services engineers will be at the heart of making business-critical systems compliant and serviceable into the future. But the whole facilities management and building services industry must come together with manufacturers and business services to help the business community to understand how the changes will affect them. Knowledge is power, and a full evaluation of existing systems will equip business leaders with the knowledge to make the right decisions to get ahead of the ban. More information and a countdown to the ban clock is available at the link below.

Kevin Groves is group operations director with Ergro

- See more at: http://www.modbs.co.uk/news/fullstory.php/aid/11893/Counting_down_to_the_ban_on_R22.html#sthash.HbKs8XtY.dpuf

Update: Car engineers pour cold water on Daimler refrigerant fire claims

29 April 2013 | By Andrew Gaved

The CRP was established to examine Mercedes owner Daimler’s claims that HFO 1234yf ignited in a staged head-on collision, whereas the previous refrigerant R134a, outlawed by the Mobile Air Conditioning directive, did not.

In the wake of lurid claims about the risk of flammability in the UK tabloid press, the SAE said CRP team members had again concluded that the refrigerant release testing conducted by Daimler is unrealistic, following numerous additional tests of various types to study ignition of an HFO 1234yf leak in a crash-damaged vehicle.

In another strongly worded statement, SAE said Daimler’s test “is not an appropriate test to verify the safety of refrigerant applications in vehicles. The Daimler testing did not include any actual vehicle collisions or the mitigating factors that occur in an actual collision.”

It said these factors include the quenching effect of front end compartment deformation, the extinguishing effect of steam released due to radiator breakage, and dispersion of the refrigerant from the condenser outside the engine compartment.

“Daimler’s refrigerant release apparatus and nozzle does not represent actual crash-damaged refrigerant lines, and was found to be artificial.”

The report was welcomed by Honeywell Fluorine Products, the manufacturer of the HFO, which emphasised that even those German manufacturers which have indicated they are in favour of using CO2 in the future cars had not found anything unsafe about the HFO.

Honeywell European managing director Paul Sanders said: “Pretty much all of the car industry has said publicly it can use 1234yf safely, including all members of the [German carmakers group] VDA, apart from Daimler. Opel had its test programme undertaken by engineering body TUV (above), which is globally respected.”

Following the report, Mr Sanders said Honeywell was now calling for the European Commission to censure Daimler for continuing to defy the MAC Directive. If strictly applied, the EC could forbid the registering of non-compliant cars, such as the Mercedes A and B class models which are still being produced with R134a, in contravention of the directive.

He said: “All we can ask is that the law is adhered to. The MAC directive is unequivocal that non-compliant cars should not be registered. The car industry has had seven years to make a compliant vehicle. HFO 1234yf is available today, it meets the MAC directive and it is cost-effective.”

Mr Sanders also claimed that Daimler’s preferred refrigerant carbon dioxide – which it has asked the EC for more time to develop – is not as environmentally friendly as HFO 1234yf across the lifetime of a vehicle.

He said: “CO2 is a smokescreen and it is three to five years away at best. As it is an asphyxiant it would need significant changes to car designs and the service charges would be higher, since if it was to leak, it would all leak at once.”

He warned that the Commission needed to take action against Daimler or risk appearing ineffectual: “It sets a dangerous precedent for the forthcoming F-Gas regulations if one company is allowed to go its own way and flout the law. Allegedly Daimler is saving 50 euros a car for not using 1234yf. It is not a safety issue, it is a political issue.”

Car engineering research group SAE International has reported the conclusions of its extensive analysis of HFO 1234yf, calling the refrigerant “safe and effective to use in automotive applications” - free to view, simply register

The team on SAE’s Cooperative Research Programme, comprising most car manufacturers from Ford to Renault to Toyota, concluded that “the risk of passenger exposure to a vehicle fire associated with this refrigerant is exceptionally remote”.The CRP was established to examine Mercedes owner Daimler’s claims that HFO 1234yf ignited in a staged head-on collision, whereas the previous refrigerant R134a, outlawed by the Mobile Air Conditioning directive, did not.

In the wake of lurid claims about the risk of flammability in the UK tabloid press, the SAE said CRP team members had again concluded that the refrigerant release testing conducted by Daimler is unrealistic, following numerous additional tests of various types to study ignition of an HFO 1234yf leak in a crash-damaged vehicle.

In another strongly worded statement, SAE said Daimler’s test “is not an appropriate test to verify the safety of refrigerant applications in vehicles. The Daimler testing did not include any actual vehicle collisions or the mitigating factors that occur in an actual collision.”

It said these factors include the quenching effect of front end compartment deformation, the extinguishing effect of steam released due to radiator breakage, and dispersion of the refrigerant from the condenser outside the engine compartment.

“Daimler’s refrigerant release apparatus and nozzle does not represent actual crash-damaged refrigerant lines, and was found to be artificial.”

The report was welcomed by Honeywell Fluorine Products, the manufacturer of the HFO, which emphasised that even those German manufacturers which have indicated they are in favour of using CO2 in the future cars had not found anything unsafe about the HFO.

Honeywell European managing director Paul Sanders said: “Pretty much all of the car industry has said publicly it can use 1234yf safely, including all members of the [German carmakers group] VDA, apart from Daimler. Opel had its test programme undertaken by engineering body TUV (above), which is globally respected.”

Following the report, Mr Sanders said Honeywell was now calling for the European Commission to censure Daimler for continuing to defy the MAC Directive. If strictly applied, the EC could forbid the registering of non-compliant cars, such as the Mercedes A and B class models which are still being produced with R134a, in contravention of the directive.

He said: “All we can ask is that the law is adhered to. The MAC directive is unequivocal that non-compliant cars should not be registered. The car industry has had seven years to make a compliant vehicle. HFO 1234yf is available today, it meets the MAC directive and it is cost-effective.”

Mr Sanders also claimed that Daimler’s preferred refrigerant carbon dioxide – which it has asked the EC for more time to develop – is not as environmentally friendly as HFO 1234yf across the lifetime of a vehicle.

He said: “CO2 is a smokescreen and it is three to five years away at best. As it is an asphyxiant it would need significant changes to car designs and the service charges would be higher, since if it was to leak, it would all leak at once.”

He warned that the Commission needed to take action against Daimler or risk appearing ineffectual: “It sets a dangerous precedent for the forthcoming F-Gas regulations if one company is allowed to go its own way and flout the law. Allegedly Daimler is saving 50 euros a car for not using 1234yf. It is not a safety issue, it is a political issue.”

FLUOROCARBON INDUSTRY CONTRIBUTES $158 BILLION TO U.S. ECONOMY

WASHINGTON,

D.C. - The Alliance for Responsible Atmospheric Policy (Alliance), an industry

coalition, today released a report detailing that the U.S. fluorocarbon

industry’s total annual sale of goods and services amounts to $158

billion.

“The

role of fluorocarbons in both stratospheric ozone protection and global climate

change has generated a need for governments, policymakers, and scientists to

understand the scope of the industry, usage patterns, business sector volumes,

and their value to society,” stated Dave Stirpe, Alliance Executive Director.

The

products analyzed by the study include hydrochlorofluorocarbons (HCFCs),

hydrofluorocarbons (HFCs), and the products that contain or are manufactured

with the compounds such as air conditioning, refrigeration, foam insulation,

and metered dose inhalers. The value to the U.S. economy is rounded out

by the value of the wholesale, installation, and maintenance activities – as

well as recovery, recycling, reclamation, and destruction of used refrigerants

and foam blowing agents.

“These

compounds and the products utilizing HCFCs and HFCs contribute greatly to the

quality of life while at the same time minimizing impacts on the stratospheric

ozone layer and the climate,” stated Stirpe. “Over the years, industry

has improved technology in food-preserving refrigeration, air conditioning in buildings

and motor vehicles, insulation systems, and other products. Businesses

are working to make transitions to compounds with more environmental protection

while continuing the important attributes contained in fluorocarbons such as

energy efficiency, low toxicity, and non-flammability,” Stirpe said.

The

39-page study, written by Joseph M. Steed, JMS Consulting, uses public data and

industry information to assess the broadly-defined US fluorocarbon

industry. A copy of the study is available on the Alliance website at www.alliancepolicy.org.

For 32

years the Alliance has coordinated industry participation in the development of

responsible international and U.S. government policies regarding ozone protection

and climate change. It is composed of manufacturers and businesses that

rely on fluorocarbons.

##

Dave Stirpe

Executive Director

Alliance for Responsible Atmospheric Policy

2111 Wilson Blvd., 8th Floor

Arlington, VA 22201

phone: (703) 243-0344

Executive Director

Alliance for Responsible Atmospheric Policy

2111 Wilson Blvd., 8th Floor

Arlington, VA 22201

phone: (703) 243-0344

email: alliance98@aol.com

website: www.alliancepolicy.org

website: www.alliancepolicy.org

China to receive $385m to eliminate HCFCs

CHINA: Up to $385m is to be given to China to end its production of R22 refrigerant.